How To Create An Llc In Wyoming

Do It Yourself

Sign up for a free account and use our online tools to start your Wyoming LLC today. Includes Wyoming LLC formation and maintenance walkthrough and company document creation. All for free—just pay state fees.

$ 0 Total

Go Monthly

Skip the state fees! Get a Wyoming LLC and the best of our services today. Includes EIN, hassle-free maintenance, business address & mail forwarding, Privacy by Default®, local Corporate Guide® service, and everything you need to operate at full capacity.

$ 35 / Month

Pay in Full

Includes Wyoming LLC, business address & free mail forwarding, free 60-day Phone Service trial, Privacy by Default®, lifetime support from local Corporate Guides® and a year of registered agent service.

$ 325 Total

Rated 4.5 / 5 stars by 254 clients on Google

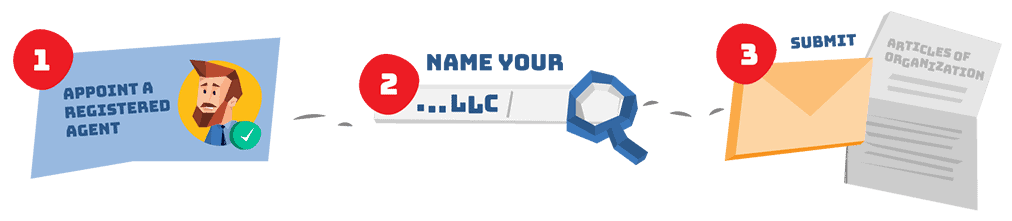

To start an LLC in Wyoming, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Organization with the Secretary of State. You can file the document online or by mail. The articles cost $100 to file (add $2 to file online). Once filed with the state, this document formally creates your Wyoming LLC.

1

Appoint a Registered Agent

According to WY Stat § 17-28-101 (2019), every Wyoming LLC must appoint a registered agent. You don't need to hire a registered agent, but if you do, make sure your registered agent will list their address on your articles wherever possible to ensure maximum privacy.

2

Name Your LLC

If you're starting a new business, you probably already know what you want to name your LLC. But you'll need to know if your preferred name is available. To find out, visit the Wyoming Business Name Search and search until you find the perfect name for your LLC.

3

Submit Wyoming Articles of Organization

Once you know who your registered agent will be and what your LLC name is, you're ready to file your Wyoming Articles of Organization. Follow along with our filing instructions below:

Learn more about each Articles of Organization requirement below. Note that the information you provide becomes part of the public record—permanently.

Or skip the form entirely and hire us to form your Wyoming LLC. We provide a free business address to list whenever possible throughout the filing to better keep your personal address private. And for the cheapest way to start a business? Pay just $35 out the door with our VIP monthly payment option.

1. Company Name

Your name must include "Limited Liability Company," "Limited Company," or an abbreviation. Most businesses keep it short and sweet with "LLC." This may sound a little obvious, but make sure your name is unique—Wyoming is quite strict about this and will reject your filing if it's too similar to anything being used, so be sure to research your name beforehand.

2. Close LLC Election

Tick the box here if you want to form a close LLC. A close LLC is designed primarily for small, family businesses to help members keep more control over their business. For example, forming a close LLC makes it tougher for creditors or outside parties to receive controlling membership interest.

3. Registered Agent and Office

Your Wyoming registered agent must be available to accept legal mail at a physical address in the state. Your agent can be an individual Wyoming resident (like yourself) or an authorized business (like us). The Wyoming address you list will become part of the permanent public record of your LLC. Prefer not to list your personal information on a public document? When you hire Northwest, our name and address will go here.

4. Mailing and Principal Office Addresses

Your mailing address is simply where you'd like to receive any notices from the state. Your principal address is the main business office of your Wyoming LLC and must be a street address. Tip: Hire us as your registered agent and you can use our Wyoming address as your principal and mailing addresses.

5. Wyoming LLC Organizer

Someone must sign as the person organizing your Wyoming LLC—but it doesn't have to be anyone in the LLC. We'll be your organizer when you hire Northwest.

6. Contact Name, Number and Email

Yes, if you put your phone number and email here, they will become a part of the permanent public record. And yes, you'll end up on all sorts of lists that will leave you with a ringing phone and an inbox stuffed with spam. We allow our clients to put our phone number and email here to save you from endless annoyances.

7. Consent to Appointment by Registered Agent

If filing with a paper form, you'll need to include a Consent to Appointment by Registered Agent form (included with the state provided articles template). Your registered agent must sign this form to indicate they have accepted the appointment.

Professionals in Wyoming hire registered agent services like Northwest Registered Agent to start an LLC—but why?

Logistics

Standard filing companies don't have employees or offices in every state. But as a national registered agent, it's a requirement for us, which is a benefit for our clients. Our office is located in Rock Springs, WY. We're on a first name basis with the people who work in Wyoming's Secretary of State. We know all the fastest filing methods, which translates to fast, professional service—without extra fees.

Privacy

As your registered agent, we list our Rock Springs registered office address on your LLC's formation documents. Why? If you're starting a business from your apartment in Laramie, do you really want your apartment address as your business address? (Hint: the answer is no.) We'll list our address, so you don't have to list yours. Plus, we never sell your data. We don't list your personal information on filings if we don't have to. It's all standard and part of our commitment to Privacy by Default®.

Free Mail Forwarding, Business Address and More

At Northwest, we do everything a registered agent should do and more. You can list our address as your business address on your state filings. We include limited digital mail forwarding with registered agent service (up to 5 pieces of regular mail per year; $15 a doc after that).

Plan on accepting credit cards? We also offer a Free Credit Card Processing Consultation. Our specialists work with processors to negotiate low rates and better contracts for our clients.

And now, try our in-house Northwest Phone Service for 60 days, free of charge with our formation service. Get a virtual phone number with your choice of area code, make and receive calls from any device, and more—for just $9 a month.

Local Expertise

We know the in's and out's of each state—and we use this knowledge to help you when you need it most. Our team of Corporate Guides® has over 200 local business experts. You can call or email us for answers to all your questions about your LLC in Wyoming.

After your Wyoming Articles of Organization are approved, you still have a few more important steps to take, including getting an EIN, drafting an operating agreement, opening a bank account, funding the LLC and learning about state reporting and tax requirements.

Get an EIN

An EIN ("Employer Identification Number") is a federal tax ID assigned to your business by the IRS. The IRS uses your EIN to easily identify your business on tax filings.

Does a Wyoming LLC need an EIN?

You'll most likely want a bank account for your Wyoming LLC, which almost always requires an EIN. You'll also need an EIN if you plan to have employees, be taxed as a corporation or file certain federal excise returns. EINs are also useful for keeping your personal information more secure—when it comes to local tax forms, licenses and registrations, you often have the choice of either handing over your EIN or your social security number (and let's face it, no one wants to hand over their social security number).

How do I get an EIN for my LLC?

You can apply for an EIN directly from the IRS at no cost. Most businesses are able to apply online, but if you don't have a social security number, you'll need to apply with a paper form. Want one less thing to do? Add on EIN service when you hire us, and we'll get your EIN for you. Or choose our VIP service—an EIN is included.

Write an LLC Operating Agreement

Operating agreements put into writing how your business actually operates—how much each member invested, how profits and losses will be allocated, how voting works, and what happens if there's a dispute or if the whole business (knock on wood) falls apart.

For more on Wyoming operating agreements (including free Wyoming operating agreement templates), see our Wyoming LLC Operating Agreement resource.

Do I need an operating agreement for a Wyoming LLC?

Wyoming doesn't require a written operating agreement. Per WY Stat § 17-29-102 (2019), an operating agreement can be oral or implied.

That said, it's always a good idea to put your LLC's internal information, policies and procedures in writing. Your operating agreement isn't just annoying paperwork. It's one of your LLC's most important internal documents, and creating one can help your LLC with everything from opening a bank account to handling major events from mergers to dissolution.

What should be in an operating agreement?

An operating agreement should explain how the business will handle "big picture" situations—everything from allocating profits and losses to dissolving the business. Below is a list of common topics that operating agreements should cover.

-

Initial investments

-

Profits, losses, and distributions

-

Voting rights, decision-making powers, and management

-

Transfer of membership interest

-

Dissolving the business

Your operating agreement can cover pretty much anything as long as it isn't contrary to Wyoming law. WY Stat § 17-29-110 (2019) sets out what an operating agreement may cover, addressing topics such as voting rights for members and how the agreement can be amended.

How do I write an operating agreement?

To write an operating agreement, you need to address how your business will handle money, members, votes, management, and more. Not sure how to get started? At Northwest, we're here to help your LLC get off on the right foot. When you hire us, we provide your business with a free LLC operating agreement, specific to your management style. We've spent years developing these agreements and other free LLC forms—which have been used by over a million LLCs.

Open an LLC Bank Account

Your LLC needs its own bank account. Why? An LLC gets its limited liability from being a distinct entity, separate from its members. If you mix personal and business finances, you could lose your liability protections.

How do I open a bank account for my Wyoming LLC?

To open a bank account for your Wyoming LLC, you will need to bring the following with you to the bank:

-

A copy of the Wyoming LLC Articles of Organization

-

The LLC operating agreement

-

The LLC's EIN

If there are multiple members in the LLC, you may also want to bring an LLC resolution to open a bank account that states that the person going to the bank is authorized by the members to open the account in the name of the LLC. Northwest can help with this as well—LLC bank resolutions are one of the many free legal forms we provide to ensure you can get your LLC started fast.

Fund the LLC

Time to put some money in that new LLC bank account. What money? For starters, your initial contributions to your LLC's capital. LLC members are owners, and each owner needs to pay for their membership interest to fund the LLC.

What is membership interest?

Membership interest is your percentage of ownership of the LLC. Membership interest is normally proportionate to your investment. So how does this work?

Imagine your LLC has 5 members. 4 members each invest $1,000 in the business. One member invests $6,000. The total contribution of all members is $10,000. The 4 members each own 10% of the business. The moneybags member who shelled out $6,000 owns 60% of the business.

Typically, this also means that the 4 members would each get 10% of any profits, and moneybags would get 60%. Exactly how profits and losses are allocated, however, can be adjusted in the operating agreement as long as changes are in line with IRS requirements and Wyoming laws.

How do I transfer assets into a Wyoming LLC?

An LLC must be capitalized. This is a key element to a Wyoming LLC. In particular, this is because LLCs can be formed in Wyoming without listing the members (owners) or providing this information to the state since Wyoming does not have an income tax return to file. You can capitalize your WY LLC with cash that you deposit into a Wyoming business bank account, and document this exchange through the LLC membership certificates. Another option is to convey assets you own into the Wyoming LLCs ownership. You can document this exchange through an LLC membership interest bill of sale. We've written up an entire article on how to transfer property into an LLC.

File Wyoming Reports & Taxes

Wyoming LLCs are required to file a state report each year, which includes an annual license tax fee based on your Wyoming assets. Wyoming LLCs may also be subject to sales tax and other state tax filing requirements.

How much is the Wyoming Annual Report fee?

The minimum fee for your LLC's Wyoming Annual Report is $60 ($62 online). The fee is based on your LLC's assets in Wyoming.

As long as your total assets are $300,000 or less, you'll pay the minimum fee of $60. If your total assets are greater than $300,000, then you'll multiply your total value by 0.0002. For example, if your LLC has total assets of $2,000,000, you'd simply multiply your assets by 0.0002 and pay $400.

When is the Wyoming Annual Report due?

Your report is due at the beginning of your anniversary month every year. Forget to file? The state will send you a delinquency notice and give you 60 days before dissolving your LLC.

When you sign up for Northwest, we send you reminders for your annual report due dates. Want one less thing to worry about? With our business renewal service, we can complete and submit your annual report for you for $100 plus the state fee.

What should I know about Wyoming LLC taxes?

There is no personal or corporate income tax in Wyoming. Many people minimize business taxes with a Wyoming LLC, using Wyoming holding companies. If you go to Wyoming and buy something or if you have a brick and mortar business in Wyoming selling something to another Wyoming resident, note that Wyoming has an average total sales tax rate of just over 5%. There are no sales tax reports or anything Wyoming LLCs have to file.

Do LLCs have to register with the Wyoming Department Of Revenue?

Even though there is no state income tax, any business with a physical presence in Wyoming is required to be licensed for sales tax collection. If your LLC is going to collect and pay sales tax, then you'll need to register with the Wyoming Department of Revenue and make periodic sales tax payments in accordance with state law.

How can I submit the Wyoming LLC Articles of Organization?

You can file Wyoming articles online or by mail. If you plan to mail your paperwork, you'll need to submit one original signed Articles of Organization and one original signed Consent to Appointment by Registered Agent form to the following address:

Secretary of State

Herschler Building East, Suite 101

122 W 25th Street

Cheyenne, WY 82002-0020

How much does it cost to start a Wyoming LLC?

The filing fee for your Wyoming LLC Articles of Organization is $100 if you file online. The state adds a $2 online processing fee, so your total cost is $102.

Hire Northwest for a one-time fee of $325, including state filing fees, a year of registered agent service, limited mail forwarding and loads of useful forms and tools to help get your Wyoming LLC up and running. Or, pay just $35 out-the-door with our VIP monthly payment option.

How long does it take to start a Wyoming LLC?

File online, and you'll typically receive your approval documents in your email within just a few minutes. If you're not in any hurry (or just really want to save the $2 online processing fee), you can print and mail your filing. You should note though that if you file the paper form, you also have to get an originally-signed consent form from your registered agent, and attach that to your LLC Articles of Organization. Logistically, it wastes a few extra days when you form a Wyoming LLC by mailing the articles yourself.

If you hire Northwest to start your LLC, we file online and typically have your Wyoming LLC formed within 24 hours.

Does a Wyoming LLC need a business license?

Wyoming doesn't have a general, statewide business license. Some cities and counties have their own business licensing requirements, however. For example, if you engage in any business in the Town of Jackson, you're required to obtain an annual business license there. Your best course of action is to do some research and see if your business will need any particular state or county licensing.

Need an EIN or a certified copy of your formation docs for your license applications? Northwest can help. You can easily add on these items to your LLC formation order.

Can a Wyoming LLC help me live more privately?

Absolutely. With no requirement for owners or managers of LLCs to list their names on their articles, a Wyoming LLC is one of the best states for helping you live more privately. The simple fact that LLCs don't have to file any personal identifying information with the state means that you can live more privately than you would in most states. You only get this kind of privacy, however, by taking the right steps, such as hiring a registered agent service like Northwest that provides a business address for public filings. By listing our address on public docs instead of your own, you'll better guard your privacy. Check out our page on living privately with an LLC to learn more.

How can I use a Wyoming LLC for asset protection?

A Wyoming LLC is one of the best LLCs for a number of reasons:

- Exclusive charging order for a judgment against the LLC

- Very conservative court system

- The WY LLC protects the LLC from its members' personal problems

- The WY LLC was made with asset protection in mind

- Wyoming values the single member LLC and provides it protection

A Wyoming LLC cannot be used fraudulently. It's important to remember that just because Wyoming has great asset protection laws for a limited liability company or corporation, you can't just not pay people and hide behind the entity. The Wyoming courts will fight and reward you for honesty and integrity, but they will quickly allow someone to pierce your corporate veil if you fraudulently defraud people you owe. The good news is if you have no bad intentions with a Wyoming LLC company, you should be protected if you run your Wyoming company properly.

How do I know I own a Wyoming LLC?

Great question. Almost every Secretary of State or Division of Corporations does not have companies supply a list of owners. It is generally assumed that the managers or members of an LLC are the owners and that officers and directors of a Wyoming Corporation are the owners. This is not always the case. In Wyoming, you do not list the members or managers in the Articles of Organization or the annual report. It's super easy to file the documents to form the LLC but hard to have well-written private documents that prove you own the WY LLC. We include all these documents with every Wyoming LLC order. If you'd like to tackle it on your own, we have many free LLC forms you can use.

What is a foreign Wyoming LLC?

Any LLC not actually formed in Wyoming is a foreign LLC. For example, if you formed an LLC in Montana but wanted to expand your business into Wyoming, you would register your Montana LLC as a foreign LLC in Wyoming. You do this by filing an Application for Certificate of Authority with the Wyoming Secretary of State. The Application for Certificate of Authority costs $100 to file. Like domestic LLCs, foreign LLCs in the state have to file Wyoming annual reports. The whole process can be a bit confusing. Why mess around when you can hire Northwest? We can register your foreign Wyoming LLC for you today, no waiting around or wringing your hands wondering if you filled out the appropriate paperwork correctly.

What about Wyoming mail forwarding?

Our registered agent service already includes limited digital mail forwarding for your regular mail (10 pieces of regular mail a year; $15 per document after that). Plus, you can list our address as your business address. That means you can have all business mail routed through our office.

Want something more robust? Our Wyoming Mail Forwarding service has you covered. We'll set you up with a Wyoming address, a unique suite number, a secure online account, and u nlimited mail forwarding . All that for just $40 a month.

Can I move my LLC to Wyoming?

Yes, there's a process, and we do it for you for only $100 plus state fees. You can do it yourself; it's just a lot of filings. If you formed an LLC in another state, you can move your LLC to Wyoming, and when you do a name search for your LLC in Wyoming, it will show your original formation date of when you organized it in another state. Wyoming also gives you a certificate with that date on it.

What is a Wyoming Close LLC?

You'll notice when reading over your Articles of Organization that there's an option to tick a box to form a "close LLC." A Wyoming Close LLC, much like a closely-held corporation, is a business structure designed primarily for small, family-owned businesses. Close LLCs have qualities that make it simpler to tightly control a company. For example, a close LLC has more restrictions on membership transfer, making it easier for members to maintain control over their business.

How can I get a Wyoming phone number for my LLC?

It's a conundrum: you need a local number to display on your website and give to customers, but you don't want to make your personal number quite so…public. We get it. And we've got you covered with Northwest Phone Service. We can provide you with a virtual phone number in any state—plus unlimited call forwarding and tons of easy-to-use features. You can try Phone Service free for 60 days when you hire us to form your LLC, and maintaining service is just $9 monthly after that. No contract required.

O ur Wyoming LLC formation service is designed to be fast and easy—signing up takes just a couple minutes. Here's how it works:

1

Signup

With Northwest, we give you flexibility on how to pay. You can pay all the fees up front (this includes one full year of registered agent service). Or, pay just $35 out the door with our VIP monthly payment option. With our VIP option, we also include an EIN. Just choose one of the buttons below, answer a few easy questions about your business and submit your payment.

2

State Approval

We'll prepare your Wyoming Articles of Organization and send them to the Secretary of State, for approval. In the meantime, you'll have immediate access to your online account, where you can find useful state forms, pre-populated with your business information.

3

Your Wyoming LLC!

Once the Wyoming Secretary of State has approved your filing, we notify you that your Wyoming LLC has been legally formed. You can now take any necessar y next steps, like getting an EIN and opening a bank account.

How To Create An Llc In Wyoming

Source: https://www.northwestregisteredagent.com/llc/wyoming

Posted by: andersonbarives.blogspot.com

0 Response to "How To Create An Llc In Wyoming"

Post a Comment